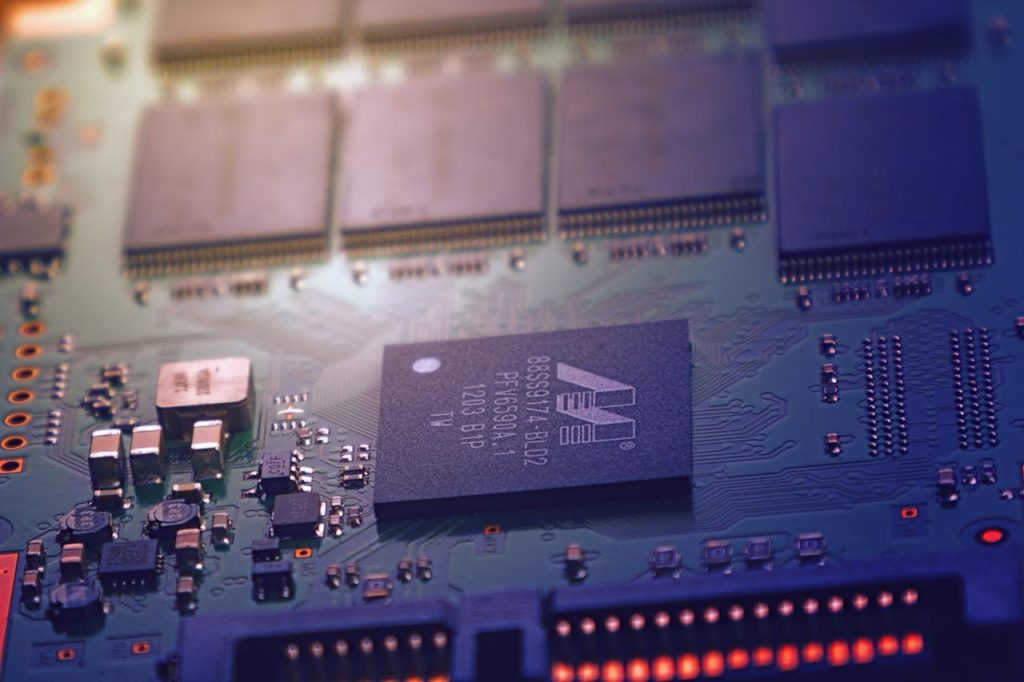

AP SAN FRANCISCO – Nvidia’s profit rose on Wednesday, beating Wall Street estimates. The company’s dominance in chip manufacturing has made it a symbol of the rise of artificial intelligence.

In the first quarter ended April 28, its net income rise from $2.04 billion to $14.88 billion, seven times higher than the same period last year. Revenue tripled to $26.04 billion from $7.19 billion last year.

Yes, Nvidia Will Make New AI Chips Every Year!!

Nvidia CEO Jensen Huang! Announced during the company’s quarterly earnings call that the company will make new AI chips every year instead of every two years after showing better-than-expected revenue. “I can say there’s another chip after Blackwell. We follow a year-long schedule,” Huang remarked. The announcement indicates that the AI chip maker will use the advantage offered by artificial intelligence.

The company’s shares are trading above $1,000 and it reported $14 billion in profits in its first quarter.

For its upcoming AI chips, Nvidia is reportedly considering an annual delivery schedule. The announcement follows rumors that, in 2025 — just a year after Blackwell unveiled the AI chip behemoth — Nvidia will launch a new processor.

Sources

According to The Verge, Nvidia has been releasing new architectures every two years until now. Ampere, Hopper, and Blackwell are some examples of these releases, due in 2020, 2022, and 2024, respectively.

Analyst Ming-Chi Kuo, however, stated earlier this month that the next design, dubbed “Rubin,” is expected to be released in 2025, suggesting that the R100 AI GPU could arrive as early as next year. I can be released. Huang’s comments indicate that the report may be correct.

Huang claimed that Nvidia will accelerate production of every other type of chip to meet this speed. Nvidia CEO Jensen Huang said on the call that the firm’s AI GPUs are both mechanically and software backwards compatible, in response to an analyst’s question about how the company will boost sales of its new Blackwell GPUs. While Hopper GPU sales are still strong.

The CEO claims that clients who now run H100, H200, or B100 data centers will have no problem making the switch.

Nvidia’s Earning Reports

Nvidia’s accelerated AI chip release schedule is a result of the company’s thriving AI chip manufacturing business. For the three months ended April 30, Nvidia reported $26 billion in sales and $6.12 in earnings per share.

Analysts had estimated adjusted EPS of $5.65 on revenue of $24.69 billion, according to sources. With a 2% margin, Nvidia projects revenue of $28 billion for the current quarter.

That’s higher than economists’ estimate of $26.6 billion. The company’s adjusted earnings per share (EPS) for the same period last year was $1.09 on $7.19 billion in revenue. During Wednesday’s extended session, Nvidia shares were seen up as much as 4%.

Nvidia’s AI-intensive data center segment, which generated $22.6 billion in revenue last quarter — a 427% year-over-year increase and a staggering 20 times the $1.1 billion the division will generate in 2020 — remains the driving engine. Financial success of the company during the last year.

Stock Information for Nvidia

Nvidia’s stock price rose 4% recently after the company released an incredibly impressive quarterly report showing a 268% increase in revenue and a 628% increase in profits.

On June 7, Nvidia announced that it would split its shares 1-for-10, keeping the company’s total value intact and reducing the price per share from about $950 to $95 to give employees and investors Easy to get full shares for.

Although non-hyperscalers tend to use more Nvidia processors, very large cloud providers account for about 45% of the company’s data center sales, according to CFO Colette Kress.

The data center division accounted for 86% of Nvidia’s total quarterly sales, with revenue up 427% year-over-year to $22.6 billion.

But Cress noted that the company had to stop shipping its most powerful chips to China, resulting in a sharp drop in sales from that market during the quarter.

What the Analysts Says?

Experts warn that stocks are never the straight and narrow. Nvidia’s price-to-earnings (P/E) ratio is an incredible 79.95. In comparison, Apple is at 29 and Microsoft is at 36. However, Nvidia’s bottom-line net income is similarly about $0.50 for every dollar in sales.

Is it able to meet demand? These days, Nvidia’s chips are in such demand that an armored vehicle is used to deliver them. The company’s stock fell 5% on Tuesday after Amazon, a key customer, informed the Financial Times that it was waiting for orders for Nvidia’s new superchip, Blackwell.

The case of China is different. The Biden administration has banned the company from selling its advanced semiconductors in China, considering a crackdown on Chinese-made electric vehicles.

According to Dan Ives of Wedbush Securities, when AI “Godfather” Jensen speaks after the results are released, investors will be paying close attention. “In our opinion, the AI party is starting with the popcorn,” he says. “AI Revolution Starts with Nvidia.”

Alena James is a technology lover who is impassioned about investigating the most recent developments and trends in the digital realm. With an exceptional ability to simplify sophisticated ideas, her mission is to ensure that technology is accessible to all. Observations and updates on everything technological are provided in a straightforward manner.